Q3 outdoor industry web traffic & trends

traffic is down, organic landscapes are shifting & paid is more competitive than ever

Web traffic across the outdoor industry remained down significantly in Q3, as we continue to see comps to the COVID-inflated 2020, a trend we expect to continue. First, we saw a much more distinct peak in traffic for Labor Day, compared to last year’s more steady trend. It will be interesting to see if this “peakiness” continues through the holidays. Big holiday traffic could land overall traffic and sales numbers closer to last year than we’ve seen so far this year.

The second major trend we’re keeping an eye on is the potential narrowing of the traffic gap to 2020. The summer months gave us the largest delta to last year, however, September showed some improvement. This is an encouraging sign going into the holidays, but we still don’t expect to fully normalize comps until at least Q1 of 2022, or perhaps even later due to continued supply chain disruptions. We’ve broken these and other trends down by specific channels below.

‘

Traffic Since Year Start, With “COVID Comp Crossover”

Q3 Web Traffic

traffic by channel

Every channel, except for affiliates, was down to last year across the industry. Despite traffic drops, conversion rate has remained only down slightly to last year, a continuation from Q2.

Shifting Organic Landscape - Media Overtaking Brands

Organic Search was the largest volume shift, likely due to less total search volume in the market compared to last year’s COVID-inflated highs, and the shift of organic rankings away from brands and towards media. The lift in affiliate traffic supports the narrative of the editorial shift of search, too.

Here, the shift in the organic landscape can be seen with the rise of a media page compared to the falling ranking position of a brand page for the term “Down Jacket.” Similar changes have been and continue to happen industry-wide.

Paid Competition is at All-Time Highs

We also saw the year over year gap in paid search traffic increase significantly from Q2 to Q3, after being nearly flat to last year. With many companies pulling back on ad spend in Q2 last year and a huge increase in paid search competition this year, this shift is to be expected. Axios reported that Google CPCs are 23% higher than pre-pandemic levels, and our data is showing a sizable increase in traffic from paid search, meaning more spend, over the same period. Given lower traffic overall, we expect to see this high competition remain through the holidays and Q4 as paid ads are still the easiest way to fill traffic gaps in the short term.

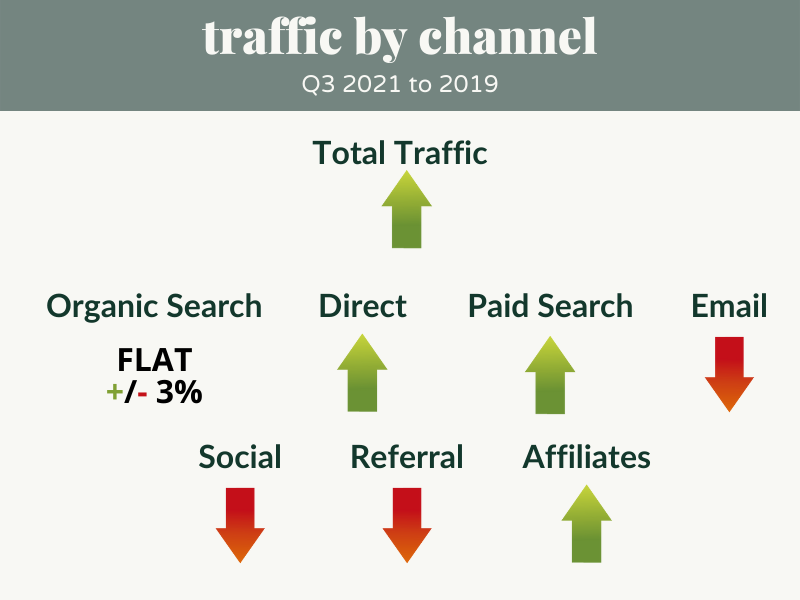

traffic compared to 2019

In order to contextualize these traffic trends better, we continue to also compare them to 2019. Looking at this more “normal” year, we see more encouraging signs. While the world and business environments are forever changed, meaning we will likely settle at a “new normal,” we are encouraged to see higher numbers than the 2019 baseline.

While organic search traffic is relatively flat, the huge increase in direct traffic tells us that more and more people are seeking out outdoor brands, with enough familiarity to be landing on their websites directly. This signals a rising tide from 2019.

Referral traffic, meanwhile, is still down significantly. This is a multifaceted story with media closures and consolidation, as well as shifts in the affiliate space. As legacy endemic outlets close their doors, web volume continues to shift to smaller mostly affiliate-based sites, and broad-market publications that do less direct linking to brands. Included in this simultaneous consolidation of major publications and fragmentation to smaller media is shifts to other channels entirely, like YouTube, which by its nature drives less referral traffic, but possibly more direct traffic further down the funnel. Likewise, larger retailers like Amazon and Backcountry.com are scooping up more of the links compared to brand sites. Affiliate’s 5x increase to 2019 helps to illustrate this as well.

takeaways & recommendations

Overall, traffic remains down across the industry, and while there are some signs of a narrowing gap, we expect this trend to continue into 2022. However, looking back to 2019, comps are more positive, showing the importance of contextualizing the current climate.

Brands are turning to paid channels to fill traffic gaps, which has driven up costs due to higher competition. CPCs are at all-time highs, and will likely continue at these levels going forward. Brands will need to evaluate the profitability of these programs and look to accelerate other channels to offset year-over-year traffic gaps.

Affiliates continue to drive huge traffic growth, up 5x to 2019, but still only make up a small portion of overall traffic, 1.2%. While growth here can be a great business driver, it’s important to approach with caution. With the rise of sneaky sub-affiliates, loyalty sites like Honey, etc - brands need to take a hard look to see if their affiliates are driving legitimate value or just skimming margin off your bottom line and inflating the channel.